www.utsclaims.com Since 2003 14419 Greenwood Ave. North Suite A-374 Seattle WA 98133 Email: support@utsclaims.com

RECEIVE 12% MONTHLY CA$H FLOW FOR

FIVE YEARS ON YOUR $30K INVESTMENT

This Straight Forward Investment Opportunity Is Secured By Real Estate You Own And Provides An Immediate 12% Monthly Rate Of Return To You For The Next Five (5) Consecutive Years!

.

FIVE YEARS ON YOUR $30K INVESTMENT

This Straight Forward Investment Opportunity Is Secured By Real Estate You Own And Provides An Immediate 12% Monthly Rate Of Return To You For The Next Five (5) Consecutive Years!

I. HOW IT WORKS:

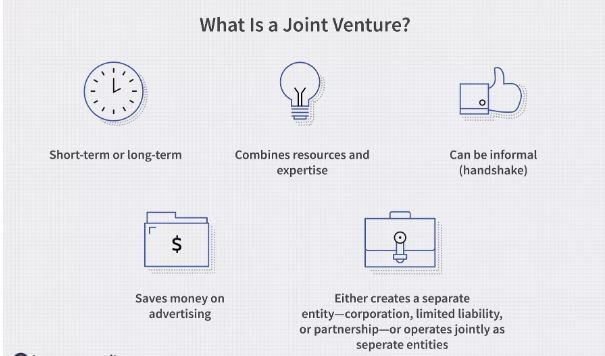

1. We Joint Venture (JV) with you as a Investment Joint Venture Partner (IJVP) for the purchase of Move-in-Ready Single Family Homes that provide immediate monthly cash flow.

2. As the IJVP, you will fund $30,000.00 towards, or for the purchase of Move-in-Ready Single Family Homes in select Cities, States and Neighborhoods.

3. The IJVP will receive an immediate monthly payout of 12% fixed rate for Five (5) years.

4. The IJVP investment capital secures and retains ownership interest in the real estate during the 5 years term of the partnership.

5. After the 5 years term, the joint venture is resolved through the LLC or other controlling entity. Thereafter, IJVP can choose to reinvest.

II. INVEST AND GET PAID MONTHLY – THAT'S IT!

II. INVEST AND GET PAID MONTHLY – THAT'S IT!

(1) The IJPV will partner with the “Director of Operations Project Manager” (DOPM) who services all aspects of the program so all you do is receive monthly checks from your investment. YOU DO NOT BECOME A LANDLORD!

(2) The DOPM will set up and interface all entities necessary to establish and operate the partnership, make monthly payments, track properties, acquire new properties etc.

(3) The DOPM is fully responsible for the Acquisition, Management and Disposition of IJVP properties as contractually defined.

(4) The IJVP funds $30,000.00 and agrees to receive an immediate 12% monthly return in the amount of $667.33 per month for 5 consecutive years at ALL times secured by the real estate.

III. HANDS OFF NO FEES SET UP, ENTITY STRUCTURING, MANAGEMENT & INTERFACE

III. HANDS OFF NO FEES SET UP, ENTITY STRUCTURING, MANAGEMENT & INTERFACE

As part of our commitment to you as a JV partner, we will pay any and all cost associated with the development and creation of all agreements required for the operation and functioning of the venture. Agreements are established between the IJVP and the DOPM defining the terms and conditions of the joint venture. Additionally, the DOPM or other quantified fiduciary shall provide all necessary services related to property management and daily operations. The DOPM duties includes all aspects of operations not limited to:

- Property Acquisition, Setup, Disposition

- Marketing and Advertising for Buyer Tenants

- Cashflow Collection and Distribution to Investors

- Notices, Evictions, Foreclosures, Complaints, etc

(a) Each investment property is purchased in the name of an LLC, Land Trust, Grantors Trust, or other entity.

(b) Each investment property will have it's own LLC, Land Trust, Grantors Trust, or other entity.

(c) The IVJP and DOPM business relationship is defined within the scope of the partnership and operating agreements of an LLC, Land Trust, Grantors Trust, or other proper entity.

IV. STANDARD DOCUMENTS TO PURCHASE AND CASH FLOW REAL ESTATE

IV. STANDARD DOCUMENTS TO PURCHASE AND CASH FLOW REAL ESTATE

The most common instruments necessary to setup and facilitate the 12% monthly cash flow program are listed below. Although these are the most common instruments required to establish the joint venture, other agreements may be required to facilitate any given transaction.

-------------------------------------------

-------------------------------------------

(a) Partnership Agreement

(b) LLC Entity Creation

(c) Trust Entity Creation

(d) Business Purpose Declaration

(e) Purchase and Sale Agreement

(f) Promissory Note

(g) Affidavit of Equitable Interest

(h) Assignment of Interest

(i) Warranty Deed

-------------------------------------------

-------------------------------------------

V. GETTING STARTED

To get started immediately earning 12% monthly cash flow secured by real estate for the next 5 years, please click the link below or give us a call at 1-877-906-5780 for any questions you may have. We look forward to partnering with you in a mutually beneficial and lucrative partnership.

.

JOINT VENTURE PARTNERS

JOINT VENTURE PARTNERSWhile earning your trust and your business, we will establish a joint venture partnership. The partnership is established to define the joint venture relationship and specific acts to be performed. Whether you are a home equity, 401K, IRA, private or hard money investor, necessary agreements will be forged to facilitate a mutual understanding and specific performance of the parties. Our collective goal is to accommodate and satisfy each individual JV partner's risk to reward tolerance while at the same time maximizing your ROI.

REAL ESTATE INVESTING MADE EASY!

Toll: 877.906.5780

Office: 206.569.3079

Monday - Friday:

8:30 a.m. to 5:00 p.m.

Office: 206.569.3079

Monday - Friday:

8:30 a.m. to 5:00 p.m.

MONEY IS ALWAYS EAGER AND

READY TO WORK FOR ANYONE

WHO IS READY TO EMPLOY IT!

READY TO WORK FOR ANYONE

WHO IS READY TO EMPLOY IT!

INVESTMENT PROCESS FUNDAMENTALS

HEPS, through and in partnership with Integrity Acquisitions Marix, LLC (IAM) and others, continues to offer joint venture partnership opportunities wherein each investor will own a limited liability company (LLCs) or Trust entity that purchase properties and fund projects that meet their investment criteria. IAM or other entity will JV with the investment partner to carry out all aspects from acquisition to disposition of the project. Investors may choose the investments that best suit their portfolio needs and diversification preferences. HEPS and it's acquisition partners anticipates that each investment’s purchase-to-disposition cycle will last from three months to five years, during which time we will continually monitor the residential real estate market—ready to implement exit strategies that provide maximum returns for all parties. The majority of profits will be realized through capital gains upon the sale of properties. Profits will be awarded according to each individual JV partnership agreement.

Through its network of experts and proprietary processes, the IAM team will continue to identify distressed prime residential real estate without limit to our acquisition model. An information package detailing each investment opportunity will be provided to prospective investors and after review, an invitation to fund and own the property via a collaborative joint venture will be offered. If accepted, all aspect of the venture will be handled by IAM and its acquisition partners. These investments will not be “funds” or “blind pools”; rather, investors will choose the investments they prefer and commit funds. IAM anticipates offering numerous investment opportunities to interested investors, who, if interested, will be expected to make a timely commitment to the investment and deliver their committed funds to escrow within 14 days of their commitment to a project. Currently, IAM is building an interest list of private investors who can make a serious commitment to the investment program.

OUR COMPETITIVE ADVANTAGE

Historically, real estate has built more wealth in the U.S. than any other asset class, and today it is considered a necessary part of a well-diversified investment portfolio. Over time, private real estate investment properties have provided diversification advantages due to lower levels of correlation with stocks, bonds, and publicly traded REITs and have typically provided a solid hedge against inflation. Drawing on a team with extensive experience in small-cap real estate investment, HEPS and its partners will identify investment opportunities brought about by the current market conditions and present them as easy-to-understand, transparent, and equitable investments.

Our JV partner business model is characterized by clear communication with proper disclosure, transparency, a focus on providing competitive risk-adjusted returns, appropriate protection of assets and capital with investors. IAM and its affiliates will partner with investors who will own 100% of the assets while we focus on daily operations from acquisition to disposition. IAM, it's partners and affiliates take pride in communication, ethical standards, vision, and leadership applying all in an effort to achieve attractive returns for our JV investment partners.

Our JV partner business model is characterized by clear communication with proper disclosure, transparency, a focus on providing competitive risk-adjusted returns, appropriate protection of assets and capital with investors. IAM and its affiliates will partner with investors who will own 100% of the assets while we focus on daily operations from acquisition to disposition. IAM, it's partners and affiliates take pride in communication, ethical standards, vision, and leadership applying all in an effort to achieve attractive returns for our JV investment partners.

THIS EXECUTIVE SUMMARY DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION TO PURCHASE, ANY SECURITIES AND IS FOR INFORMATIONAL PURPOSES ONLY. SUCH SOLICITATION OR OFFER WILL BE MADE ONLY TO PRIVATE AND HARD MONEY INVESTORS AND ONLY FOLLOWING DELIVERY BY HOME EQUITY PROTECTION SERVICES, LLC AND/OR ITS PARTNER INTEGRITY ACQUISITIONS MATRIX, LLC. OF A CONFIDENTIAL INVESTMENT PARTNERSHIP AGREEMENT AND OTHER RELATED INSTRUMENTS PROVIDED TO FULLY DEFINE THE EXTENT OF THE RELATIONSHIP.

RISK MANAGEMENT

The company's real estate risk management plans are based on three general strategies; avoiding risk, controlling risk, and transferring risk. Our number one tool for risk management is knowing the inside and out of every potential real estate investment opportunity we consider prior to contracting the deal.

That means using and partnering with qualified professionals to advocate on our behalf prior to purchase. Additionally, the necessary escape clauses are included in our contracts to circumvent any undisclosed fact that could effect the valuation of our acquisitions.

The company's real estate risk management plans are based on three general strategies; avoiding risk, controlling risk, and transferring risk. Our number one tool for risk management is knowing the inside and out of every potential real estate investment opportunity we consider prior to contracting the deal.

That means using and partnering with qualified professionals to advocate on our behalf prior to purchase. Additionally, the necessary escape clauses are included in our contracts to circumvent any undisclosed fact that could effect the valuation of our acquisitions.

TRANSACTION ENGINEER

Transaction Engineering is the art of creating win/win transactions either on the buy side or the sell side of a real estate deal. We thoroughly explore the prospect's needs and work toward a mutually beneficial solution for our clients and JV investment partners.

As an investment partner you become a big part solving problems for homeowners, banks, counties, asset managers and the like while at the same time earning a profit. And yes, like any business opportunity, you reap the benefits of your investments.

Transaction Engineering is the art of creating win/win transactions either on the buy side or the sell side of a real estate deal. We thoroughly explore the prospect's needs and work toward a mutually beneficial solution for our clients and JV investment partners.

As an investment partner you become a big part solving problems for homeowners, banks, counties, asset managers and the like while at the same time earning a profit. And yes, like any business opportunity, you reap the benefits of your investments.

PROJECT MANAGER

The role of our project managers during real estate and construction projects is to ensure a timely and successful completion of the project within the proposed budget. Although the project scopes, size and location may change, one thing is consistent; ensuring the timely and cost effective completion of projects.

Our role as your investment partners is to do just that. Vet and hire a qualified team of professionals in their field. When necessary to hire contractors, we often engage individuals or small businesses for cost control, ease of both manageability and accountability. .

The role of our project managers during real estate and construction projects is to ensure a timely and successful completion of the project within the proposed budget. Although the project scopes, size and location may change, one thing is consistent; ensuring the timely and cost effective completion of projects.

Our role as your investment partners is to do just that. Vet and hire a qualified team of professionals in their field. When necessary to hire contractors, we often engage individuals or small businesses for cost control, ease of both manageability and accountability. .

REMEMBER, WE DO ALL THE HARD WORK!

One of the key benefits of being a private money investor is putting your money to work while someone else does the actual work. You are literally hiring us to put your money to work for you in real estate. As a private money lender, besides knowing your investment is secure with 100% ownership interest in the asset, there is really nothing else to do but sit back a watch your profits grow.

Another huge benefit of being a private money lender is being able to participate in the real estate market passively while receiving a return on your investment. We do all the hard work of managing the property while the lender gets to collect the check. As a private money lender you are truly exercising the old "Make Money While You Sleep" adage.

To learn more and get started, complete and submit your preliminary investment criteria above. Upon receipt you will be contacted by a JV investment partner who will answer any questions you may have. You can also CLICK HERE for a short review of our Private Money Investments presentation for a quick overview.

One of the key benefits of being a private money investor is putting your money to work while someone else does the actual work. You are literally hiring us to put your money to work for you in real estate. As a private money lender, besides knowing your investment is secure with 100% ownership interest in the asset, there is really nothing else to do but sit back a watch your profits grow.

Another huge benefit of being a private money lender is being able to participate in the real estate market passively while receiving a return on your investment. We do all the hard work of managing the property while the lender gets to collect the check. As a private money lender you are truly exercising the old "Make Money While You Sleep" adage.

To learn more and get started, complete and submit your preliminary investment criteria above. Upon receipt you will be contacted by a JV investment partner who will answer any questions you may have. You can also CLICK HERE for a short review of our Private Money Investments presentation for a quick overview.

CLICK HERE TO COMPLETE THE COMPREHENSIVE REAL ESTATE INVESTMENT QUESTIONNAIRE